ETF Investing Academy

by Investing with Chris

Build your own personalised ETF portfolio.

Go from complete beginner to confident investor.

You want to invest but you don't know how? You're not alone. The world of investing can feel confusing and overwhelming. Where do you even start?

This comprehensive course guides you through every step, from understanding the basics to building your own personalised portfolio of Exchange Traded Funds (ETFs) and other investments.

Over 10 value-packed modules, you'll:

Over 10 value-packed modules, you'll:

A practical and interactive learning experience that's designed around you.

This course is perfect for you if...

-

You feel lost in the world of investing, confused by jargon and endless options

-

The idea of retiring early sounds appealing, but you don't know how to get there

-

The thought of investing makes you anxious, worried about making mistakes with your hard-earned cash

-

You want the confidence to make your own decisions, not rely on other people

-

You don't want to hand over a chunk of your potential profits

-

You're busy and need a way of learning that fits around your life, not the other way around

-

You want to get stuff done; not just learn stuff

Build Your Own ETF Portfolio Step-by-Step

Set Your Investment Goals

Design Your Target Portfolio

Start Investing!

Hi, I'm Chris

I'll be guiding you through this journey, step by step.

I'm thrilled to join you on your investing journey and honoured that you've chosen this course to help you.

I'm thrilled to join you on your investing journey and honoured that you've chosen this course to help you.

About Me

You may know me from my Instagram page - @investingwithchris - where I aim to educate and inspire new investors with visual infographics.

This course is an opportunity to take this to a whole new level. Expect even more of the graphics and visuals you're used to seeing on Insta, but following a step-by-step approach that helps you apply it to your own personal situation.

This course is an opportunity to take this to a whole new level. Expect even more of the graphics and visuals you're used to seeing on Insta, but following a step-by-step approach that helps you apply it to your own personal situation.

What's included?

Unlock a toolkit of 10 modules, designed to support your journey from beginner to confident investor.

41 Value-Packed Lessons

Learn everything you need to know in easy-to-understand, bite-sized chunks.

10 Quizzes

Test your understanding and reinforce your learning as you go with multiple choice quizzes

Real-World Scenarios

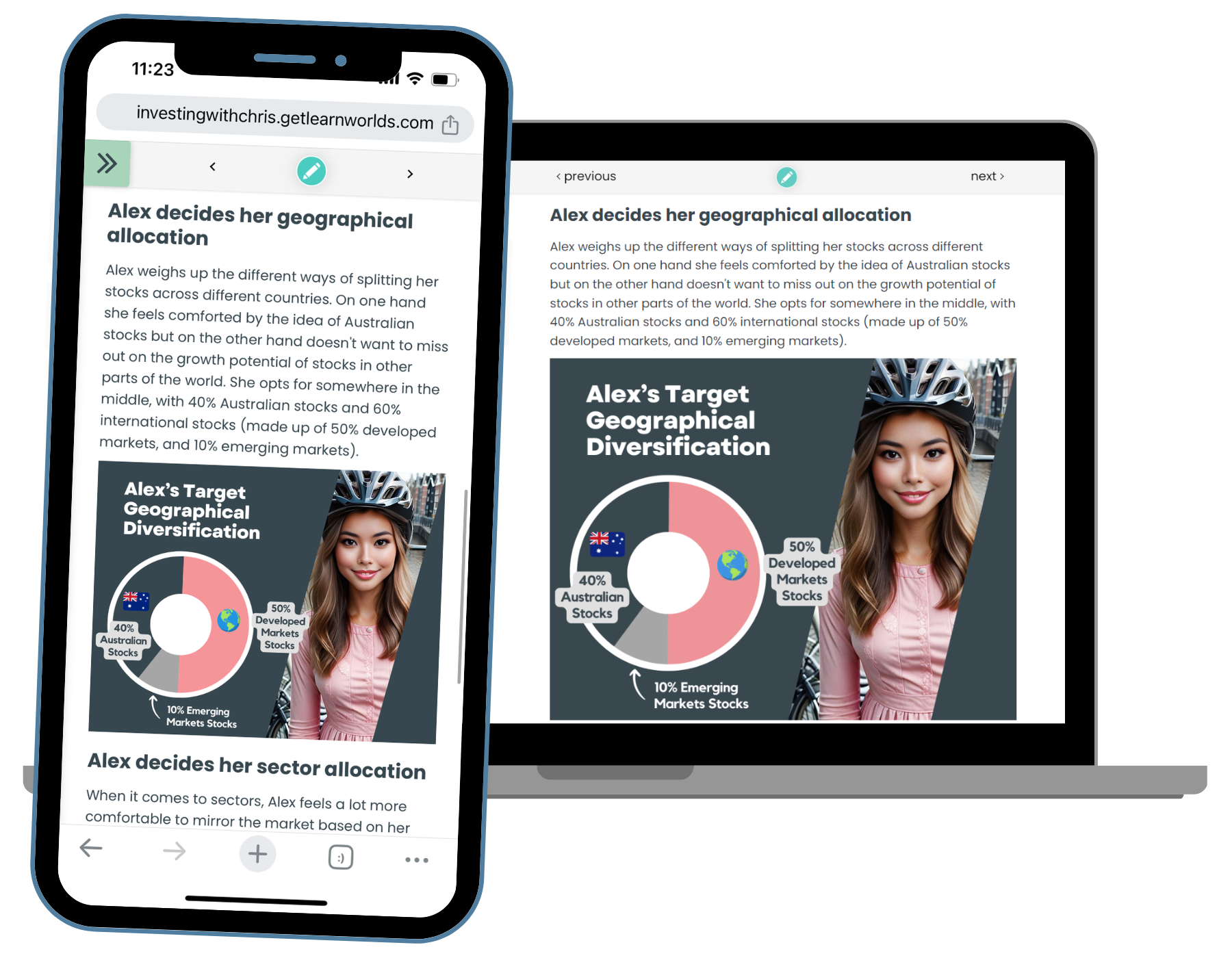

Learn from our fictional character "Alex" as she applies the lessons to build her own personal ETF portfolio.

8 Practical Assignments

Apply what you learn in real-time with guided activities at the end of each module.

Community Discussion

Connect with others on a similar journey to you. Share ideas, ask questions and get support.

10 PDF Workbooks

Exclusive access to recaps, cheat sheets, step-by-step guides, templates and examples.

Course Contents

Try it Free Today!

More questions? Check out the FAQs below.

1. What will I learn in this course?

You'll start as a beginner and finish as a confident investor, knowing how to build and manage your own ETF portfolio. We'll cover everything from the basics of investing to choosing your broker and tracking your investments.

2. Who is this course designed for?

Anyone who wants to learn about investing, especially if you’re starting from scratch. No previous knowledge is needed—just a desire to learn and take control of your finances!

3. How long does the course take to complete?

The course is self-paced, but typically, you can complete it in your own time and convenience. Most students tend to finish all 10 modules in a few weeks.

4. Do I need any prior knowledge or experience in investing to join this course?

Not at all! This course is designed for complete beginners. Everything is explained in simple, easy-to-understand language.

5. What types of investment strategies will this course cover?

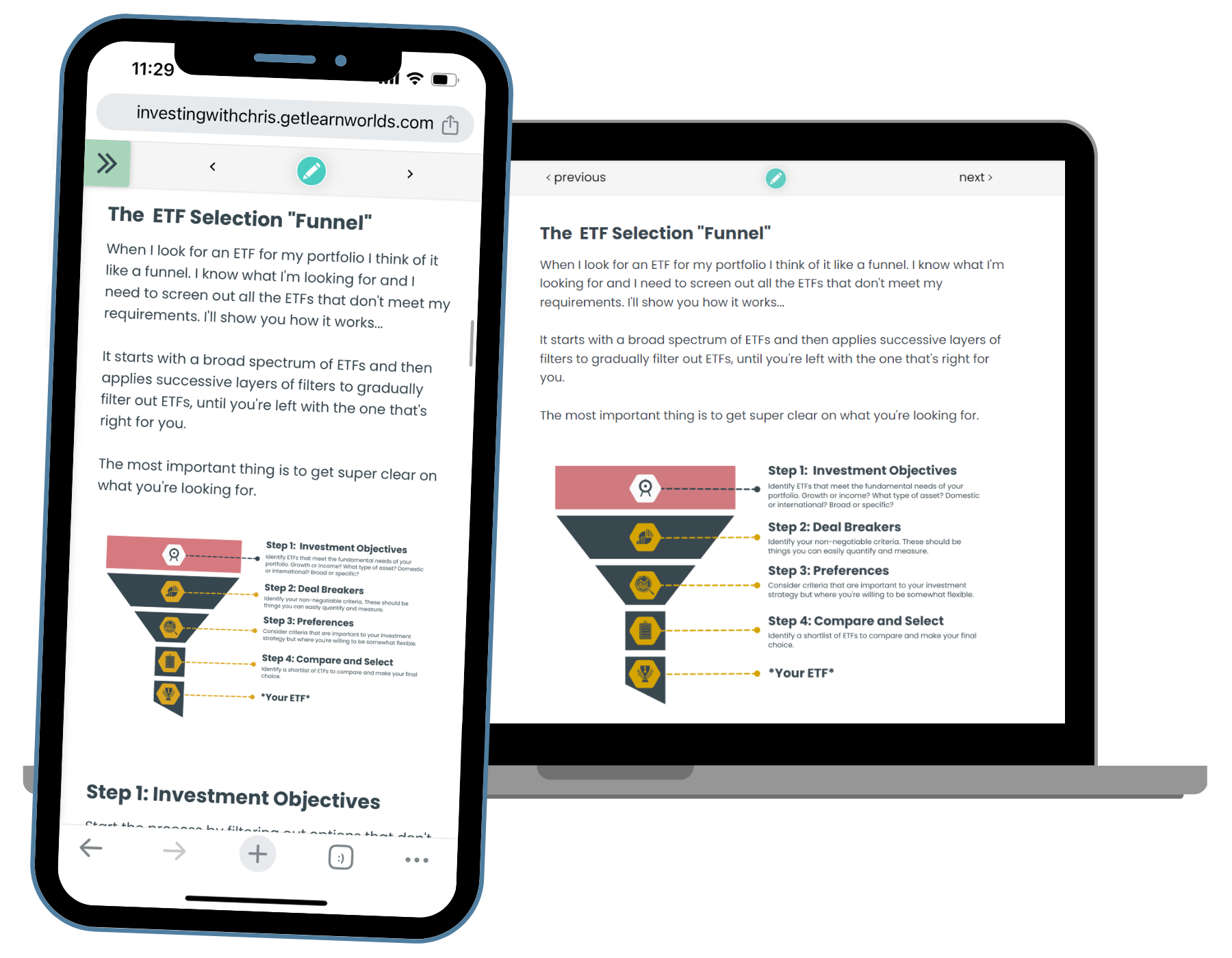

The course focuses on building an ETF portfolio. You'll learn how to select ETFs, structure your portfolio, and understand different investment strategies within the context of ETFs.

6. How is the course content delivered?

All course materials are delivered online through engaging graphics, visuals, interactive elements, and practical assignments. You can access it anytime on any device—laptop, tablet, or mobile.

7. Can I access the course on my tablet or mobile device?

Yes, the course is fully responsive, so you can learn on your laptop, tablet, or mobile at your own pace and convenience.

8. Do I have to be online at a specific time to take a course?

No, you can take your course whenever you want. The course remains online around the clock. All you need is internet access and a fairly modern browser.

9. Is there a community or forum where I can interact with other students?

Yes, our course platform includes a community feature where you can ask questions, interact, and share ideas with fellow students and even ask me directly.

10. Are there any hands-on projects or practical sessions included?

Each module includes practical assignments to apply what you’ve learned to your personal situation. You’ll build your ETF portfolio step-by-step, just like our fictional character, Alex, in her investment journey.

11. What payment options are available?

You can pay through various secure and encrypted methods available on our platform.

12. Is there a money-back guarantee or a trial period available?

Yes, you can try one module for free! Plus, there's a 14-day money-back guarantee if you’re not satisfied and haven’t progressed past module 3.

13. How does this course compare to other investing courses online?

Unlike other courses, which can be overwhelming and disorganised, this course offers a structured, step-by-step approach. This makes complex topics simple and actionable, reducing confusion and helping you truly understand how to invest wisely.

14. Can I interact directly with the instructor during the course?

Yes, you can send me, Chris, direct messages through our course platform. I'm here to help answer your questions and guide you through your investing journey.

15. How soon can I start learning after I purchase the course?

You can access the course immediately after purchasing. Everything is available right away, so you can start learning at your own pace.

16. Can I access the course content offline?

The course requires an internet connection. However, you can download PDFs, cheat sheets, and templates for offline study.

17. Can I access the course content after completing it for future reference?

Absolutely! You have lifetime access to the course content after you enroll. This means you can come back and review any section whenever you need a refresher or want to clarify a specific point.

18. Are there any additional costs or fees after purchasing the course?

No, your one-time payment covers all course materials. There are no hidden fees or additional costs for accessing the course content.

19. How do I know if this course is the right level for me?

This course is designed for beginners with no or some prior knowledge of investing. It starts with the basics and gradually builds up to more complex concepts. If you're looking to understand ETF investing from the ground up and develop a solid foundation, this course is perfect for you.

20. Can I get a preview or a free sample of the course before committing to the full purchase?

Yes, you can access a module of the course for free before deciding to purchase. This free module helps you get a sense of the teaching style and course quality.

21. What kind of outcomes can I expect after completing this course?

By the end of this course, you’ll be able to understand the fundamental principles of ETF investing, create a diversified ETF portfolio tailored to your financial goals, and manage your investments with confidence. You’ll have practical knowledge and tools to begin investing on your own or enhance your current investment strategy.

22. Is there a way to track my progress throughout the course?

Yes, the course platform includes a progress tracking feature that allows you to see which modules you've completed and what's next on your learning journey. This feature helps you manage your learning pace and ensures you don’t miss any important content.

23. Which countries is this course relevant to?

The course is based on principles that are applicable globally, wherever you live. Note that specific examples of ETFs are from the Australian market.

24. How focused is the course on ETFs compared to investing in general?

About 80% of the curriculum is about investing in the stock market, with about 20% specific to ETFs. Many of the principles of building an investment portfolio (e.g. setting your goals, understanding your risk tolerance, asset allocation and diversification) are not specific to ETFs. However, we then move on to cover ETF-specific strategies, portfolio construction, and management.